What is the Business Records Exception?

A business records exception is a commonly used exception to the Florida rules of evidence that allows a party to introduce evidence into a court proceeding without having a witness testify regarding the creation of underlying evidence. Simply put, it allows for the introduction of a document without a witness having to provide testimony that the document was created as a part of the regular business operations of an organization, such as a corporation, health care provider or government agency.

Both the Florida Rules of Evidence and Federal Rules of Evidence contain provisions governing business records . The Florida Rules are modeled after the Federal Rules, however, the Federal Rules have even more exceptions and typically place more evidentiary rules upon their application in litigation. Florida Statute section 90.803(6) provides the business records exception for state trials and the Federal Rules of Evidence 803(6) provides the exception for federal trials.

Introduced in 1998 with the passage of the Evidence Code Revision Project, the business records exception was incorporated into the state evidentiary laws, codifying exceptions already present in common law. The rules governing the admission of business records allow for a level of efficiency and streamline the resolution of cases by eliminating unnecessary testimony and prolonging trials.

Statutory Authority in Florida

The legal authority for the business records exception in Florida is, in a sense, two fold: (1) the Florida Rules of Civil Procedure and (2) The Florida Evidence Code. In my experience the Florida Evidence Code tends to be the more useful tool because it is the rule of evidence that applies to both civil and criminal cases. However, in the context of civil litigation the Florida Rules of Civil Procedure can be a useful tool as well.

With regard to the rules of evidence, the Florida Evidence Code (codified in Florida Statutes, Title VIII, Chapter 90, Section 90.902) lays the foundation for the exception. This statute allows for certain records of regularly conducted activities, such as the evidence of an accident or incident, or the records of the maintenance or development of personal, medical or other products to be introduced as evidence if either made by, kept by or in the custody of a person with knowledge in the regular course of business. The list of examples cited above are just a few of the types of records that may fall under the business records exception, as well as the type of records that are often at the forefront of a personal injury or wrongful death lawsuit. Another relevant statue within the Florida Evidence Code is Section 90.803.6, which places the burden of proof on the party making the claim in the case that the record does not meet the business records exceptions set forth in Section 90.802.

In addition to the foregoing, the Florida Rules of Civil Procedure (codified in Florida Statutes Title VI, Chapter 1, Rule 1.310) does offer a party in a case the ability to obtain the production of documents, records, writings, etc. that are related to the event or incident that is the basis of the lawsuit. Under Section 90.342(2), the records that are obtained must be authenticated through testimony or by way of deposition duces tecum that is intended to capture the business records in question. A business that creates a product or provides a service should have systems in place whereby records likely to be requested in litigation can be located, authenticated and produced or otherwise ready for production in a way that is defensible and not unduly burdensome to the business.

Admissibility Requirements

In order for a document to be admitted under the business records hearsay exception, the document must meet certain criteria. The record must have been made at or near the time the matter described in the record occurred. The record must also have been made at or near the time by, or from information transmitted by someone with knowledge, and must have been kept in the course of the regularly conducted business activity.

The record was kept in the course of normal business activity; a regular practice of that activity. In other words, a document made or received and kept for the regular course of business must be made or received and kept as a regular practice, not just on an isolated occasion. A four-part test is used to determine the admissibility of the record as a business record. This involves showing that a witness testifies that:

In the context of insurance coverage, for example, a carrier may create a document assessing risk, such as a Trip Rater, as part of its "underwriting" process. The computer system that produces the Trip Rater for a particular risk must have been able to perceive facts about the particular risk in question and provide that assessment as a regular practice of the system.

Applicability to Florida Companies

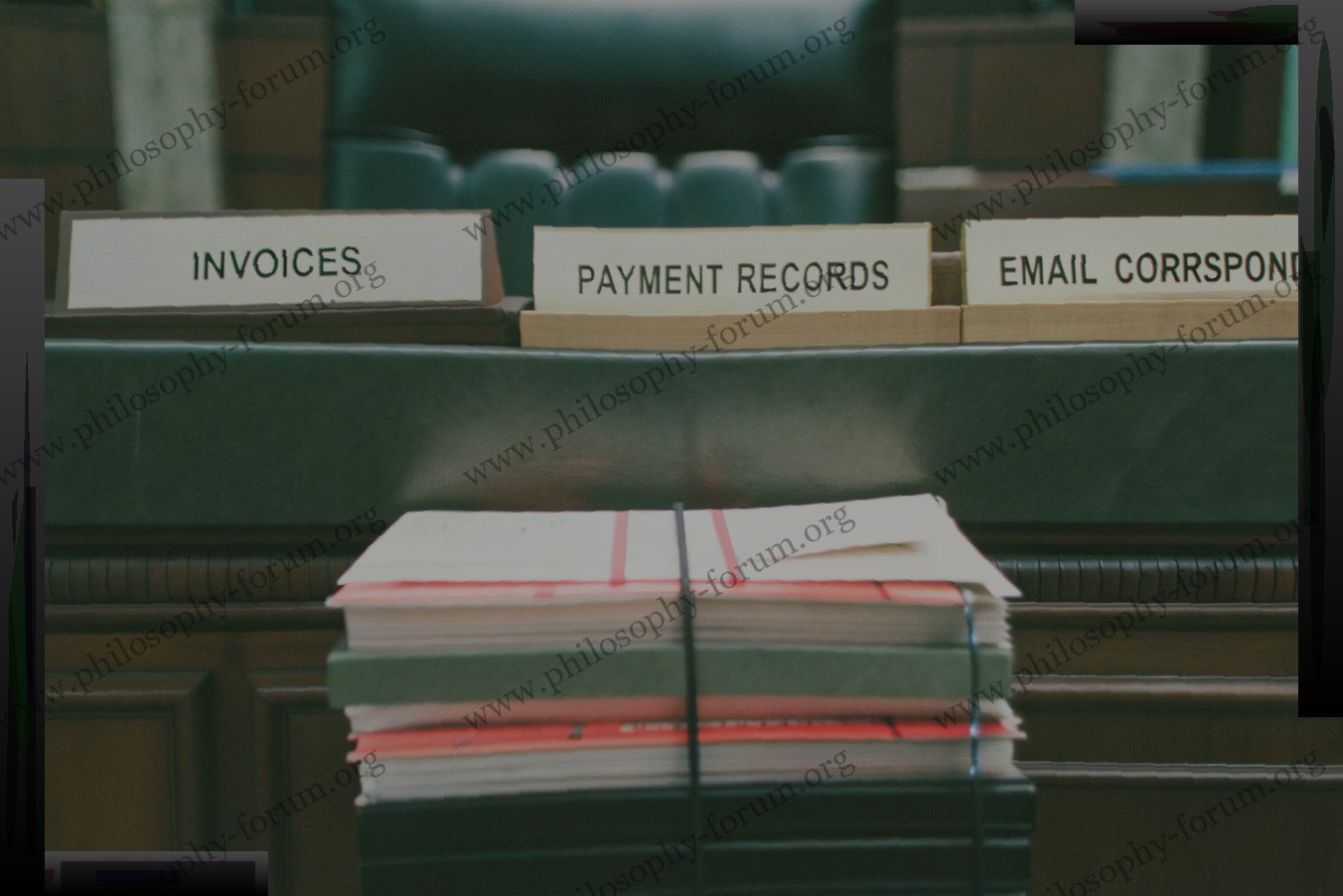

The use of business records in Florida courts can be an effective way for Florida businesses to substantiate claims, defense, or an affirmative defense. For example, if a Florida business is owed a sum of money from a contracting job or invoice, the business can use business records (such as invoices and payment records) to establish its claim. If sued, in addition to prevailing on an affirmative defense, a Florida business may also seek to establish a counterclaim by using business records showing amounts owed to the business by the plaintiff or other third parties.

If opposing a claim, a Florida business can use a business record to establish the absence of certain events or acts. For example, using an emails to establish non-communication with the other party over a certain matter, or phone call records to establish that the business did not contact the other party. Additionally, a Florida business can use invoices to show that the plaintiff breached a contract (by not paying money due) or affirmatively breached after a contract had been terminated (by requesting goods or services after the relationship ended) .

Using the business records exception can alleviate several issues for Florida businesses, including, reducing the amount of time need for a deposition, reducing the cost associated with litigating a matter, and removing the need to have the involved employees or other individuals testify in person.

However, the business records exception is not without its challenges and pitfalls. For example, a Florida business will need to ensure that it has an established procedure in place for creating, implementing, and storing the business records that is involved in the matter. Depending on the date of creation of the business records, a Florida business may not be able to rely on the business records exception. Further, if the involved employees or other parties are still available to testify, even if it is not desirable to have them testify, the business records they created may be excluded to establish the information contained therein.

When using the business records exceptions, a Florida business should work with an experienced Florida litigation attorney to ensure that the issues discussed above are properly addressed.

Recent Cases and Precedent

A number of court cases in recent years have examined the limits of the business records exception. In State v. Balvin, a 2006 case before the District Court of Appeal of Florida, the court clarified that documents such as and including an employee time clock report could be admissible through the business records exception. However, the party offering the evidence must also establish that the report is what it purports to be, by a witness with personal knowledge. This requirement can be satisfied through an affidavit of a competent custodian of records, who can present evidence as to the process by which the report was created, along with the custodian’s signature. Thus, the report did not qualify for the business records exception, "because there was no witness to authenticate it, or, in other words, not prove that it was a true and correct copy of the business record." (Internal citations removed.) A second appeal on this matter in 2008 found that the employees whose time was reflected in the time card spreadsheets had been fired and could not be located. Since the custodian was available at the second trial, these spreadsheets qualified for the business records exception to hearsay under Florida Statute Florida Statutes 90.803(6). Also in 2006, the District Court of Appeal of Florida examined the admissibility of telephone records of a doctor, offering another view of the requirements for admissibility under the business records exception to hearsay. In Wong v. Avery, the court found that there was insufficient evidence or testimony to establish that the telephone records were admissible as business records under Florida Statute Florida Statutes 90.803(6). The types of evidence required to establish admissibility under this statute can include testimony from a custodian or other qualified witness, or an affidavit by a custodian or qualified witness pursuant to Section 90.902(11), Florida Statutes (2005), or both. In the absence of the required evidence, the trial court had not abused its discretion by refusing to admit the records.

Helpful Tips

To help prevent any issues with the use of business records, Florida businesses would be well advised to institute the following best practices:

- (1) Employ reasonable safeguards to keep records secure: Information security can prevent malicious (or ill-advised) elements from modifying or deleting records and can allow for the establishment of a record keeping chain of custody in the event of a later authentication dispute.

- (2) Set who is responsible for and accountable for keeping records and monitor those in charge of maintaining security and integrity of business records: This establishes a clear chain of custody, which goes a long way in allowing for the establishment of the credibility and authenticity of records produced in litigation .

- (3) Consistently train workers on policies and procedures related to the storage, creation, modification, and deletion of records: This may seem like tedious work; however, litigation will undoubtedly result in a greater inconvenience for all parties involved than would the document review stage. If you can install policies and procedure to mitigate the chances that records will not be available for introduction later, it may save time and effort.